Outlook Money has remained India’s No.1 personal finance magazine for the last 25 years, delivering accurate, insightful, balanced and practical information to our readers that is easy to understand and implement. Since our inception in 1998, we have focused on consumer interest and benefits. We empower our readers by giving in-depth analysis and credible information on investments, insurance, taxation, banking, financial planning and all things related to your household budgets and financial goals. We are not an investment-only magazine, though stocks and mutual funds inevitably form a significant chunk of our content, because we are concerned about the overall financial well-being of individuals and not just wealth creation.

THE BURDEN OF DECISIONS

Talkback

Outlook Money

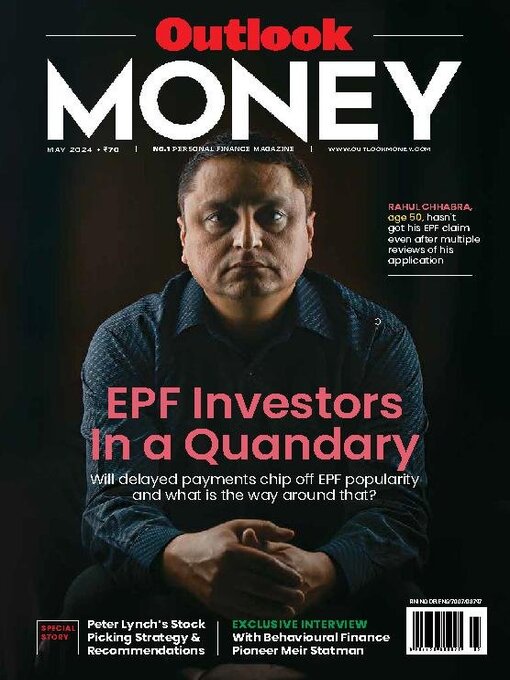

DELAYED CLAIMS CHIP OFF EPF POPULARITY? WHAT YOU CAN DO • The Employees’ Provident Fund remains the most popular retirement saving tool for the majority of Indians. Of late, there has been an increase in the number of claim rejections, putting investors in a quandary. We tell you what can lead to such rejections and what you can do to deal with or avoid such a situation

How To Minimise Chances Of Claim Rejection

Types Of Legal Remedies

THE PETER LYNCH GUIDE TO PICKING STOCKS • Investor, fund manager and a best-selling author, all rolled into one—that’s Peter Lynch. His books provide nuggets of practical approach to stock investing. We demystify his investing style to help you implement it when picking stocks. We also have some picks based on his strategy that you may consider

Peter Lynch's Investing Style

STOCKS TO CONSIDER

'People Are Normal. They Are Sometimes Ignorant But They Are Not Stupid' • Meir Statman, the Glenn Klimek Professor of Finance, Leavey School of Business, Santa Clara University, California, is the second generation of behavioural finance experts who refused to label people as “irrational” and instead called them “normal”. In his latest book, A Wealth of Well-Being: A Holistic Approach to Behavioral Finance, he expands the circle of finance to include life well-being and shows how they are inextricably intertwined. As part of an interview series, ‘Wealth Wizards: Money Maestros in conversation with Nidhi Sinha, Editor, Outlook Money’, Statman spoke about his research, and explained concepts through anecdotes that can help you take balanced decisions. Edited excerpts:

3 Cognitive/Emotional Errors To Be Conscious Of

HOW TO MAKE SENSE OF THE GOLD RUSH? • The precious metal has been on an upward rally for the last couple of years due to factors as diverse as geopolitical conflicts, bulk buying by central banks, and hope of rate cuts, of late. The key, therefore, is to invest in gold in a staggered manner

Small And Mid Cap Rally: Be Wary • You may include small- and mid-caps in your portfolio for diversification, but understand that they may not replicate last year’s returns and are relatively more volatile

Worthy Of Its 'All-Season' Name

Essence Of LIFE: Living in Financial Empowerment • A financially empowered life is not just about surviving but embracing a journey towards financial wisdom, which can lead to freedom and security

3 THINGS TO CHECK BEFORE YOU EXIT YOUR POLICY • If you think that the insurance policy you bought doesn’t quite align with your goals, you may surrender it. But that comes at a cost. Here’s why you should do the calculations

Hybrid Fund Solution for Equity Benefits with Lower Risk • Hybrid funds offer a decent investment solution for individuals seeking a balanced approach to wealth creation with lower risk as they usually invest inmultiple asset classes

The Future Of Credit Card Usage • Credit card usage is increasing in India, but it’s prudent to manage credit wisely

Teach Them...

Jun 01 2024

Jun 01 2024

May 01 2024

May 01 2024

Apr 01 2024

Apr 01 2024

Mar 01 2024

Mar 01 2024

Februrary 2024

Februrary 2024

Jan 01 2024

Jan 01 2024

Dec 01 2023

Dec 01 2023

Nov 01 2023

Nov 01 2023

Oct 01 2023

Oct 01 2023

Sep 01 2023

Sep 01 2023

Aug 01 2023

Aug 01 2023

Jul 01 2023

Jul 01 2023